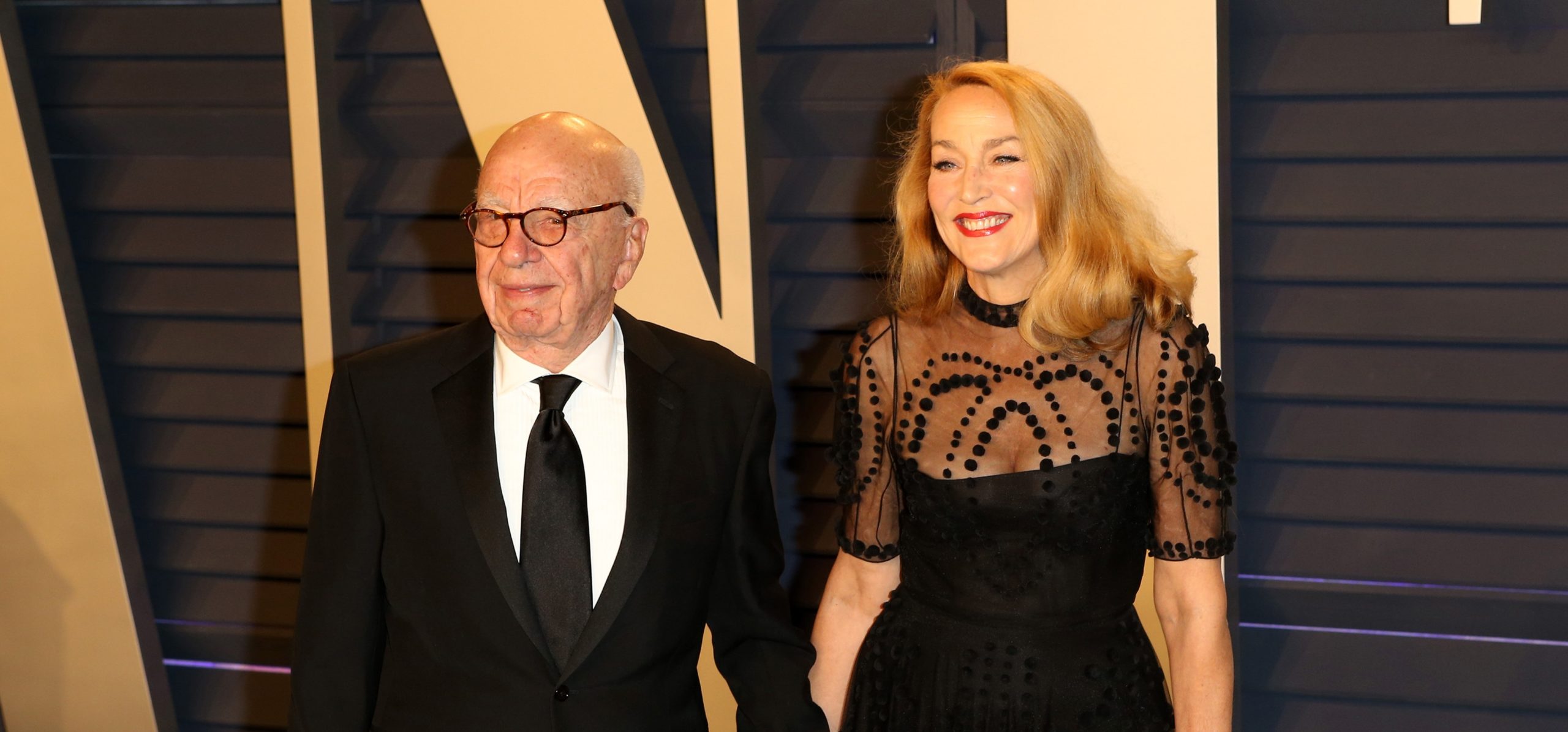

It has been reported that billionaire Rupert Murdoch and his model and actress wife, Jerry Hall, are set to divorce in what could be a very expensive separation. How the assets are to be divided will however, depend on whether there was a pre-nuptial (or post-nuptial) agreement in place. It is not yet clear whether the parties signed any such agreement.

The Courts will consider a number of factors when deciding how to deal with the financial settlement and a pre-nuptial will potentially be taken into account. To consider how a pre-nuptial or post-nuptial agreement can impact on the overall settlement we need to first look at the case in more detail:

Background

Rupert Murdoch is 91 years of age and Jerry Hall is 65 years of age. The parties met in 2015 and were married in March 2016. This has therefore, been a relatively short marriage of six years. Jerry and Rupert have 10 adult children between them. Jerry has four children with rock legend Mick Jagger and Rupert has six children from a number of previous marriages.

Rupert Murdoch is reported by Forbes to have a current net worth of c£14.7billion compared to Jerry Hall who is reported to be worth c£16.5million.

The Assets

Assets will generally be considered in two categories, matrimonial assets and non-matrimonial assets. Matrimonial assets are financial assets that have been acquired during the course of the marriage, or relationship and non-matrimonial assets are financial assets which were acquired pre-marital or post-separation.

The parties have a number of shared assets which were acquired within the course of the marriage including a Georgian property in Oxfordshire worth c£11.25million, a 340,000acre cattle ranch near Yellowstone National Park worth c£228million and a manor worth c£30million in the Cotswolds.

There are also other properties including a ranch in California, vineyard in Los Angeles and a farm in Australia, although it is unclear whether these properties were acquired within the six-year marriage.

Rupert also owns a number of media outlets, including, Fox News, The Times of London and The Wall Street Journal. If a pre-nuptial agreement was entered into, it is likely that Rupert would have protected his business.

There are likely to be many more assets which will be taken into consideration including investments such as shares, pensions and on and offshore investments. There may also be lavish personal possessions; Jerry’s engagement ring alone is estimated to be worth over £2.4million.

The Court’s considerations

The Courts will have regard to all the circumstances of the case. Firstly, consideration will be given to the welfare of any minor child of the family (although this is not relevant in this case as the parties have adult children). The Court also takes into account Section 25 of the Matrimonial Causes Act 1973 which amongst other factors includes the ages of the parties and the length of the marriage and the parties’ standard of living.

The Courts will then look at the parties resources and needs. Where the parties are in a position of high net worth, such as in this case, the Court will look beyond their basic needs and look at ensuring the assets are apportioned fairly.

If a pre-nuptial agreement was not in place then the Court would most likely adopt the sharing principle, where the starting point would be an equal division of the matrimonial assets (this is particularly the case in long marriages) although some assets generally will not be considered within the sharing principle such as inherited assets, intergenerational businesses and discretionary trusts.

Pre-nuptial/post-nuptial agreement

Although pre-nuptial agreements are not yet legally binding in England, they will be considered within all the circumstances of the case or as conduct which would be too important to disregard, alongside the above factors. In recent years, the Courts have found that they will “give effect to a pre-nuptial agreement that is entered into by the parties are their own free will, without undue influence or pressure with a full appreciation of its implications unless the circumstances prevailing it would not be fair to hold the parties to their agreement.”

A well-drafted pre-nuptial agreement will help protect parties’ assets which they brought into the marriage such as houses or businesses. Pre-nuptial agreements will vary and will be tailored specifically to each case. If there is a pre-nuptial agreement in place, then the Courts would take this into consideration and any financial settlement between Rupert and Jerry would likely be in the same terms as to what was agreed in their pre-nuptial agreement.

The purpose of a pre-nuptial agreement is to provide certainty as to how assets will be divided in the event that the marriage breakdowns. Having a fair pre-nuptial agreement can prevent potentially lengthy and expensive court proceedings. We would always advise couples to consider a pre-nuptial or pre-registration agreement.

If you want to find out more information about pre-nuptial agreements, please contact a member of the family team.

The above is meant to be only advice and is correct as of the time of posting. This article was written by Jade Mercer, Solicitor in the Family team at Pinney Talfourd LLP Solicitors. The contents of this article are for the purposes of general awareness only. They do not purport to constitute legal or professional advice. Specific legal advice should be taken on each individual matter. This article is based on the law as of July 2022